A friend of mine is a finance/economics journalist for [Insert name of newspaper you've heard of here]. He's an interesting fellow: back in the 80's he was a city boy during the big bang/ Wolf of Wall Street era of excess and he's got a list of entertaining stories as long as your arm about that era. However, these days he seems to enjoy his role as poacher turned gamekeeper, and we chat about this sort of thing a lot. He asks me interesting questions, like when the ONS released data on UK productivity he was musing when the last time anyone asked me how productive I am, and how anyone in the ONS could do more than wildly estimate that across a population.

He also sometimes says things which make me completely reassess my thinking, and he did that a few weeks ago. "There's no such thing as left wing or right wing economics", he said. "That's like saying there's left wing and right wing gravity. There's just economics. Ideology is how you respond to the effects and conclusions which can be drawn from it."

I shut up and went away then, as I needed to filter that through my thinking.

Anyway, I got me to thinking about economics again a few months ago, when the Guardian ran an article entitled This is not a recovery, it is a bubble - and it will burst. If you fancy reading it, please go ahead. I'll wait.

What it basically says is that the UK stock market is an economic bubble doomed to burst, and this conclusion is reached because there has been quite a lot of money printed over the last few years and the performance of the FTSE doesn't appear to reflect the wider economy of the UK. It's fairly well written were it not for the fact that it's a load of hopeless old pony. There's no particular reason for the FTSE to reflect the UK economy; 47% of stock issued on the exchange is now held by non-UK parties, and the defining economic fact of the last decade or so has been the startling growth in wealth in previously poor places in the East. There's an unimaginably huge (and it's only going to get bigger) tidal wave of money circling the earth from the East looking for places to settle and earn a return, the FTSE is a massive beneficiary of this as the UK economy is perceived internationally as a safe haven (more on this later). Some recognise this and some don't; I recall a few months ago David Cameron being criticised for leading a trade delegation to China to drum up business and it being said that Cameron "is selling us to the Chinese".

Well, I should bloody hope so. If the British Prime Minister weren't trying to encourage wealthy foreigners to give us their money I'd think he was being positively negligent.

So that's the main thing that the article gets wrong; the FTSE doesn't reflect the UK economy not because it's in a bubble. It reflects the emerging global economy of suddenly wealthy people who would rather like to own stock in things like BAT, BAE, and the Post Office. And in return they give us a cut every time they buy some.

Over the last few years there's been a rush of this sort of article - people who totally missed the last crash coming being desperate to call the next one, especially by people who wanted George Osborne to fail as if the UK returned to growth - and it has, the fastest growth of any developed economy - it would undermine their ideological position vis-a-vis economics.

Speaking personally I can't help but admire the way such commentators like Polly Toynbee and Mr Chang have noticed there's good money to be made from telling middle-class socialists what they want to hear. I find the irony delightful.

Anyway, the article wasn't a complete loss as it got me thinking about economic bubbles and how - and if - they do indeed relate to our current economic situation. People always talk about bubbles but it's important to understand what a bubble is and is not, and what it looks like. one of my favourite economic charts is this one. It's a bubble:

Remember that. It's important. There may be a test later.

That's the 'classic bubble', but you can see it in practice too. The most famous being the price of tulip bulbs during the Dutch 'Tulip Mania' of the 1600s:

Then there's the Nasdaq/dotcom bubble of the early 2000s, which taught me a sharp lesson:

And more recently, bitcoin:*

I hope that illustrates what I'm talking about. To an extent, economics is the study of repeating patterns in an chaotic system; Mandelbrot covered this in his book the Misbehaviour of markets, but to summarise: patterns often repeat, and the trick is to watch for them emerging and to have an idea what happens when they repeat - and what to do if they don't. Even the very best stock analyst I've ever encountered didn't get more than 70% or so of his calls right - the important thing, he told me, is to promptly accept that you're wrong and things aren't going to plan and just change your position. Don't cling to what you think should happen. Look for what is happening instead.

In some ways it's like Zen; remove the self from your assessment of what is happening. The world does not care what you think should happen, and nor should you.

Anyway, about that FTSE bubble. Here's a picture of the FTSE:

Can you see a bubble there? No, you can't, and that's because there isn't one. So I wouldn't worry about it if I were you.

Prophets of doom always find an audience, especially after times of turmoil. People fear a repeat and when someone tells them it's coming it's human nature to listen and demand something be done. On the plus side I can reassure you as there isn't another crash coming any time soon. On the down side these doom-mongers will get to crow sometime soonish as there is a recession coming. How do I know? Because there's always a recession coming. Recessions/downturns/dips, call them what you will are a regular part of economic activity. Crashes are unusual, but recessions aren't. They happen all the time, and fairly predictably, thus:

2008: Credit Cruch

2001: post 9/11 recession

1992: Black Wednesday

1987: Black Monday

1979: Winter of Discontent

1972: Secondary banking crisis

Every 7-8ish years a downturn comes along, so we're getting due. My guess is (but by no means the only possibility) that it will be triggered by the Bank of England raising interest rates, which is why Vince Cable was telling the BoE not to do so yet the other day as any slowdown before the next election would almost certainly decide the outcome. Certainly a recession pre-election will severely damage the coalitions big gun that is greater economic credibility than Labour. What I reckon will happen is that BoE won't raise until after the election (or shortly enough before that it won't knock on until after) and we'll see a dip in late 2015-16. You heard it here first, etc.

Of course this will, as usual, be held up as a failure of capitalism and all that old crap, but it's perfectly natural. In fact trying to prevent recessions, as happened in 2001 when the credit taps were turned on post-9/11, just makes this ever so much worse later when it all hits at once. Interestingly, the last time a crash this bad happened - the Secondary Banking Crisis of the early 1970s - the causes were almost identical. Faced with slowing growth the government loosened credit creating a run on property as people turned cheap money into bricks and mortar, and then suddenly interbank lending died as people got afraid their creditors couldn't pay them back. This spiralled down fast after that.

The thing to remember is that when we hit the next downturn and the usual suspects start spouting on about how it's a failure of markets blah blah, is that all systems fail - even theirs. What you need is a system with multiple suppliers whereby if one part fails there's enough redundancy in the system that there's not a cascade of failure which takes everything with it.

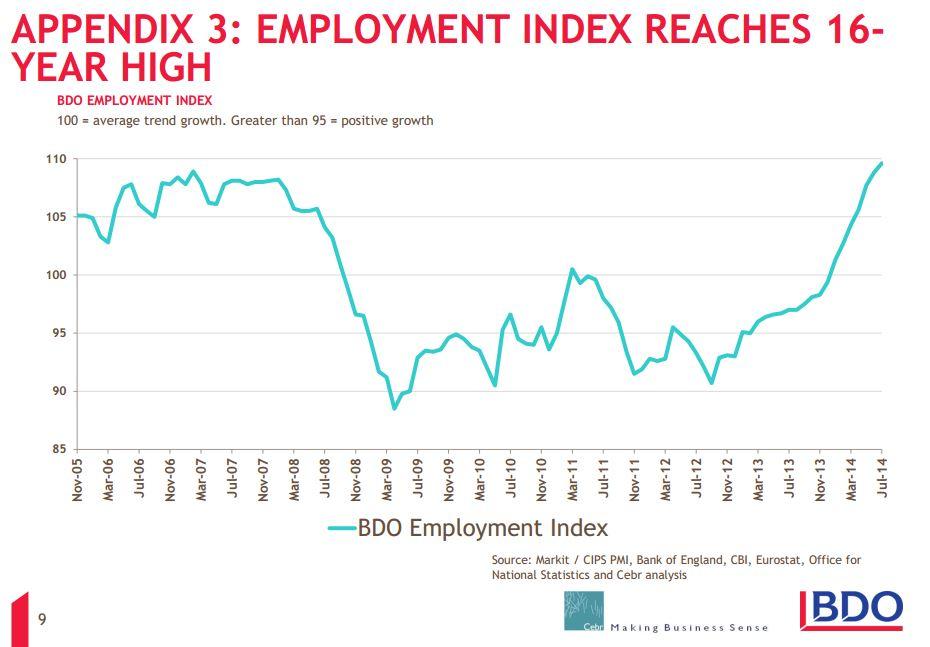

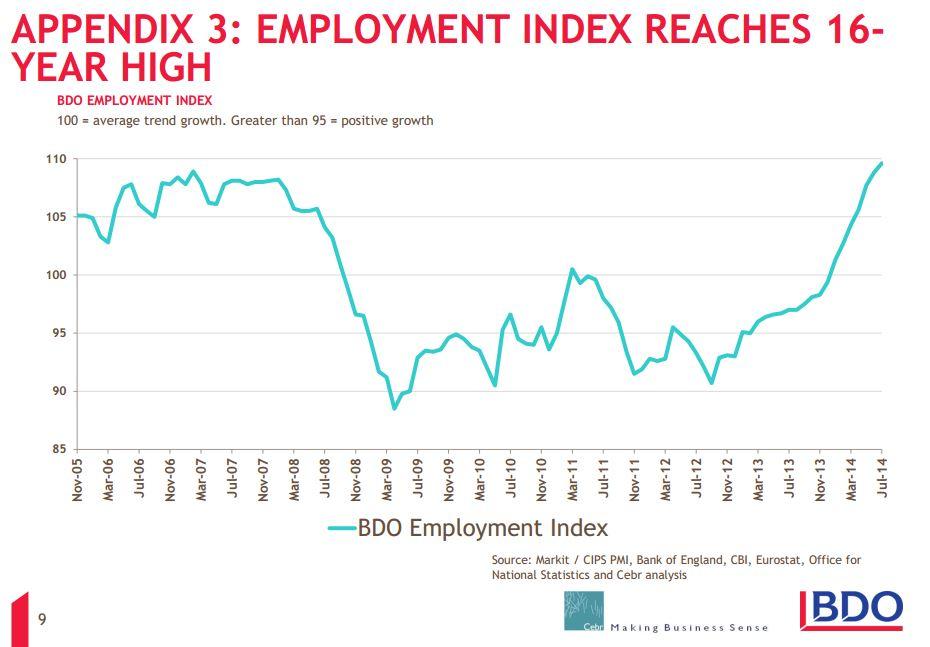

The thing we did differently post 2008 was Quantitative Easing, and you know how I said earlier that the important thing is to recognise when you're wrong? Well, I got it wrong on QE. It has clearly worked far better than I thought it would. We've avoided the lost decade of the 70s better than I expected. The UK has the strongest economic growth in the west. In fact, the numbers are quite remarkable. Since records began in 1972, six of the seven best months for job creation have occurred in the last two years; in fact, employment is at it's highest in sixteen years - higher, even, than during the years of the boom, thus:

Moreover, the CBI began to track business confidence in 1976, and they report that confidence has never - never - been higher than it is now. And those two things combined with a third factor get very interesting.

You see, a few years ago the war cry of the anti-Coalition was "Austerity isn't working", but if you google that phrase you'll notice only a few holdout diehards are still using it for the simple reason that austerity has clearly pretty much worked. As a result, Ed balls has vanished from our televisions and the war cry has changed. Now the criticism is either that we're experiencing a "Debt fuelled recovery" or that we're into a housing bubble. Let's look at both those claims, shall we?

1) It's a debt fuelled recovery!

No it's not. Investigating this one led me to this interesting little dataset:

There's several things which jump out about this. Firstly, look at the shape of that graph. Recognise it? 'course you do. You saw it earlier and I said there'd be a test. Now you see why it was a credit bubble. And you also see why Blair jumped ship in 2007.

The second thing you should notice is that debt origination in the UK is at historic lows and is still contracting:

Now bring those three things together: Fastest job creation growth since records began, highest business optimism since records began, and historically low debt origination rates. What happens next? I'll leave you lot to figure that one out. Hint: It's positive.

A related criticism is that although employment has risen, productivity and wage growth remains comparatively low. Well, in some ways that's be expected; by comparison productivity growth in the US is high but employment growth has remained steadfastly below UK levels. What's happening is that the UK is trading off productivity for employment. If you want to boost productivity, the easiest way to do that is to sack your 10% least productive staff. As a society, the route the Uk appears to have decided to go is to ensure more people have jobs at the cost of economic productivity - and this hasn't been driven by the government. It's just happened. You'd think my left wing friends would be delighted, but I'm not seeing it.

Just to put the cherry on the cake, the Cost of Employment index has risen for the first time in ages; what that means is that wage growth is reappearing. Hurrah everyone!

2) It's a house price bubble!

No, it's not. There's a couple of things you need to see to understand this one. Firstly is the distribution of rises in housing costs, which looks like this:

It's instantly clear that house price changes are not only concentrated in London, but that prices are falling elsewhere. But what about house prices in London. Are they a bubble?

No. Thus:

If this is a bubble, it's only just begun. However, I don't think it is. Instead, it's something else. I don't know what it is - but I do know what it isn't. It's almost certainly a boom, but booms act differently to bubbles.

Faced with the economic reality, opponents of the coalitions economic policies are reduced to selecting a handy grab-bag of soundbite policies - We should renationalise the railways, we should renationalise energy - in an attempt to draw attention away from the gaping hole in the middle of their economic argument.

The thing is, soundbite policies are demonstrably based upon inaccurate statements. Don't believe me? Allow me:

1) The railways. Nationalisation has failed. We have the highest subsidies of railways in Europe, which go into private companies pockets due to the Tories feeding their fat cat city chums. Or "Bollocks" as I like to call it.

State subsidies to the private train operating companies have fallen astonishingly since Labour left power. From a subsidy of £1.4bn in 2009-10 to the privatised rail industry generating a profit for the government in 2012-13. I'm aware that "Labour subsidising their fat cat city chums" doesn't fit the narrative, but the numbers don't lie even when point-scoring politicians do, and the numbers are here:

From a subsidy of a billion and a half under Labour, the coalition have managed to make a profit of over half a billion quid last year - not that you'll see many people acknowledging it as it doesn't fit their political position. As for the "highest subsidies in Europe" line, that has never held up. France has subsidised their railways more than 30% more than the UK in cash terms over the last decade or so, and in terms of passenger miles the Greeks forked out in excess of 300% what the UK did until the wheels came off their economy. Indeed, massive oversubsidy of their rail system was a contributory factor in the economic collapse of their nation.

Indeed, after all the criticisms of the UK rail network it turns out that according to the European Commission the UK has the second-best railways in Europe after the Dutch, who follow a similar ownership model to the UK.

2) Then there's energy prices. The narrative here is "Privatisation has failed, expensive energy prices, yakketty schmacketty", but once again let's say that's debatable at best. Digging for energy prices got me this interesting dataset, which I've annotated with handy points for convenience:

1) Nationalisation

2) Thatcher

3) Privatisation

4) Labour (and the introduction of carbon taxation).

It's sobering to think that five years ago on these very pages I predicted that government interference in the energy markets would lead to a price bubble, as I didn't realise it was already well under way. Even the Committee on Climate change acknowledges that carbon taxation has led to a rise in energy costs, but hey, that's not stopped people from demanding the energy industry be nationalised. Notwithstanding that doing so would be in breach of EU single market regulations, here's something else to bear in mind: take a look at the end of that price graph. That pattern...looks a bit familiar, doesn't it? It's almost like we've seem something similar, earlier in this post. What this suggests is that energy prices are pretty much peaked and several things serve to back that up; developments in Photovoltaics are especially positive, but hydrocarbon extraction techniques, nuclear, even wind and wave power are improving all the time.

In short: if your idea of a tip-top economic plan which is guaranteed to make everything better is for the government to break international treaties by using taxpayers money to buy the energy industry at the highest price since records began and when it looks probable that prices are going to go into long term decline, then God help you. Really. Nothing else will.

In many ways it's those improvements in technology which are really where I'm going with this post, and indicate where I think a lot of people get economics wrong. I had a conversation with someone a while ago who said that the economy should be managed for the benefit of the people, apparently with a completely straight face. You see, there's no such thing as an economy, or a market, as distinct from the people. What the economy is, is an emergent property of the interactions of untold millions of people all trying to make the best for themselves in whatever way they see fit - so when you talk about managing it you're actually talking about managing people and I think it important to bear that in mind.

And it's people who are the reason the prophets of doom are probably wrong. Here's why:

Over the last few decades, the number of people living in poverty round the world has fallen off a cliff; the entire human race is more prosperous than ever before to a degree it is actually difficult to imagine. Now, I believe people are creative, adaptable, intelligent and imaginative and as they get richer they tend to get better educated, having more time to spend reading books and stuff. What this means that we have an ever-growing mass of educated, intelligent, creative people who are going to be coming up with ways to make your life better. What's more, the richer people get the more peaceful they become, as they've got something to lose by starting fights.

There's a reason the UK is benefiting from this growth in wealth and education in a way that many countries are not - it's because the UK is selling something very few places provide: stability. The Russian and Chinese governments have indicated they aren't to be trusted with your savings, so if you're a Russian and Chinese millionaire where do you put your money? The same goes for Europe - ever since the EU introduced capital controls on Cyprus and the French introduced a 75% top rate we've seen capital flight from the continent to the UK at unprecedented levels. In fact, even as global trade has slowed, it's continued growing in the UK; consider this:

That's because we're honest. As governments around the world decide that sticking their clammy digits ever deeper into their people's savings is a cracking way to cover their own policy failings, their people are smartly removing their money to somewhere that doesn't happen - here. And it's not just individuals, it's major companies. I was delighted to notice the other month that ChryslerFiat, the world's 4th largest car manufacturer, has decided to domicile in the UK - thereby both showing that the Coalition's corporate tax regime is attractive and ending the old "No British companies make cars any more" line in a single stroke.

Whilst on the one hand this influx of cash is driving the rise in property prices (developments in London have been sold off-plan in Hong Kong and never even advertised in the UK**), on the other hand this money is going into companies and stock and shares as investment, which in turn has driven at least some of the rise in employment.

And this is what I meant at the start of this post about there being no such thing as left wing or right wing economics, there's just economics. It's not left or right wing to say that price controls cause shortages; the shortages will happen, and ideology is whether you think that's a good thing or a bad one and if you're prepared to accept the consequences of your actions. In the same way it's not left or right wing to say that people are intelligent, able, creative, imaginative and willing to change their behaviour if it's in their interests to do so. Economics is based upon that observation; the question of ideology is how much you want to control the economy, and that means how much you want to control the people. Conflicts arise when people and governments disagree on what their best interests actually are.

When I started this post, what I really intended to get across is how optimistic I am about the future. I know I've gone all over the place, but my core position is this: people are great. They're clever, imaginative, creative and all that good stuff and they're really good at solving problems. Furthermore, there are more and more rich and educated people all the time, which means we're only going to keep getting better at this.

Yes, there will be recessions and depressions and bubbles and crashes, but barring catastrophe the direction is relentless. If you're unconvinced think about just how much better life got for pretty much everyone who doesn't live in a berserk communist state between the last global crisis in the 1970s and the most recent one now. When I was growing up famine was a regular problem in large parts of Asia and Africa. Now the same parts of the world are worrying about obesity. Stuff like that.

Of course there will be shocks and horrors; patterns play out right up until they don't. NATO and the Ukraine could start shooting each other; the Da'ish could overrun the middle east and introduce a new dark age; we could have a global ecological collapse; China and Japan could start shooting at each other over the Spratleys (possibly the most likely, I think). Prophets of doom will always find an audience, but I'll tell you one thing: the bull market we'll see over the next decade will be the least popular one ever as so many people have pinned their political and economic credibility on it not happening.

Because ye shall hear of wars and rumours of wars, be ye not afeared: for such things must needs be; but the end is not yet.****

*Yes,![[livejournal.com profile]](https://www.dreamwidth.org/img/external/lj-userinfo.gif) raggedyman, I'm looking at you.

raggedyman, I'm looking at you.

**Do rich foreigners have an unlimited appetite for overpriced London property? No.***

***As a good example of the honesty I was talking about earlier, an estate agency friend was telling me about a conversation he had with a Malaysian client recently:

"I do like dealing with British estates agents", said the client. "You're so honest."

"Ah, that's really not how we're seen here", he pointed out.

"Yes, but in Britain when an estate agent sells you a house, you can be confident the house actually exists."

****I think I'll go and get on with writing my book now.

He also sometimes says things which make me completely reassess my thinking, and he did that a few weeks ago. "There's no such thing as left wing or right wing economics", he said. "That's like saying there's left wing and right wing gravity. There's just economics. Ideology is how you respond to the effects and conclusions which can be drawn from it."

I shut up and went away then, as I needed to filter that through my thinking.

Anyway, I got me to thinking about economics again a few months ago, when the Guardian ran an article entitled This is not a recovery, it is a bubble - and it will burst. If you fancy reading it, please go ahead. I'll wait.

What it basically says is that the UK stock market is an economic bubble doomed to burst, and this conclusion is reached because there has been quite a lot of money printed over the last few years and the performance of the FTSE doesn't appear to reflect the wider economy of the UK. It's fairly well written were it not for the fact that it's a load of hopeless old pony. There's no particular reason for the FTSE to reflect the UK economy; 47% of stock issued on the exchange is now held by non-UK parties, and the defining economic fact of the last decade or so has been the startling growth in wealth in previously poor places in the East. There's an unimaginably huge (and it's only going to get bigger) tidal wave of money circling the earth from the East looking for places to settle and earn a return, the FTSE is a massive beneficiary of this as the UK economy is perceived internationally as a safe haven (more on this later). Some recognise this and some don't; I recall a few months ago David Cameron being criticised for leading a trade delegation to China to drum up business and it being said that Cameron "is selling us to the Chinese".

Well, I should bloody hope so. If the British Prime Minister weren't trying to encourage wealthy foreigners to give us their money I'd think he was being positively negligent.

So that's the main thing that the article gets wrong; the FTSE doesn't reflect the UK economy not because it's in a bubble. It reflects the emerging global economy of suddenly wealthy people who would rather like to own stock in things like BAT, BAE, and the Post Office. And in return they give us a cut every time they buy some.

Over the last few years there's been a rush of this sort of article - people who totally missed the last crash coming being desperate to call the next one, especially by people who wanted George Osborne to fail as if the UK returned to growth - and it has, the fastest growth of any developed economy - it would undermine their ideological position vis-a-vis economics.

Speaking personally I can't help but admire the way such commentators like Polly Toynbee and Mr Chang have noticed there's good money to be made from telling middle-class socialists what they want to hear. I find the irony delightful.

Anyway, the article wasn't a complete loss as it got me thinking about economic bubbles and how - and if - they do indeed relate to our current economic situation. People always talk about bubbles but it's important to understand what a bubble is and is not, and what it looks like. one of my favourite economic charts is this one. It's a bubble:

Remember that. It's important. There may be a test later.

That's the 'classic bubble', but you can see it in practice too. The most famous being the price of tulip bulbs during the Dutch 'Tulip Mania' of the 1600s:

Then there's the Nasdaq/dotcom bubble of the early 2000s, which taught me a sharp lesson:

And more recently, bitcoin:*

I hope that illustrates what I'm talking about. To an extent, economics is the study of repeating patterns in an chaotic system; Mandelbrot covered this in his book the Misbehaviour of markets, but to summarise: patterns often repeat, and the trick is to watch for them emerging and to have an idea what happens when they repeat - and what to do if they don't. Even the very best stock analyst I've ever encountered didn't get more than 70% or so of his calls right - the important thing, he told me, is to promptly accept that you're wrong and things aren't going to plan and just change your position. Don't cling to what you think should happen. Look for what is happening instead.

In some ways it's like Zen; remove the self from your assessment of what is happening. The world does not care what you think should happen, and nor should you.

Anyway, about that FTSE bubble. Here's a picture of the FTSE:

Can you see a bubble there? No, you can't, and that's because there isn't one. So I wouldn't worry about it if I were you.

Prophets of doom always find an audience, especially after times of turmoil. People fear a repeat and when someone tells them it's coming it's human nature to listen and demand something be done. On the plus side I can reassure you as there isn't another crash coming any time soon. On the down side these doom-mongers will get to crow sometime soonish as there is a recession coming. How do I know? Because there's always a recession coming. Recessions/downturns/dips, call them what you will are a regular part of economic activity. Crashes are unusual, but recessions aren't. They happen all the time, and fairly predictably, thus:

2008: Credit Cruch

2001: post 9/11 recession

1992: Black Wednesday

1987: Black Monday

1979: Winter of Discontent

1972: Secondary banking crisis

Every 7-8ish years a downturn comes along, so we're getting due. My guess is (but by no means the only possibility) that it will be triggered by the Bank of England raising interest rates, which is why Vince Cable was telling the BoE not to do so yet the other day as any slowdown before the next election would almost certainly decide the outcome. Certainly a recession pre-election will severely damage the coalitions big gun that is greater economic credibility than Labour. What I reckon will happen is that BoE won't raise until after the election (or shortly enough before that it won't knock on until after) and we'll see a dip in late 2015-16. You heard it here first, etc.

Of course this will, as usual, be held up as a failure of capitalism and all that old crap, but it's perfectly natural. In fact trying to prevent recessions, as happened in 2001 when the credit taps were turned on post-9/11, just makes this ever so much worse later when it all hits at once. Interestingly, the last time a crash this bad happened - the Secondary Banking Crisis of the early 1970s - the causes were almost identical. Faced with slowing growth the government loosened credit creating a run on property as people turned cheap money into bricks and mortar, and then suddenly interbank lending died as people got afraid their creditors couldn't pay them back. This spiralled down fast after that.

The thing to remember is that when we hit the next downturn and the usual suspects start spouting on about how it's a failure of markets blah blah, is that all systems fail - even theirs. What you need is a system with multiple suppliers whereby if one part fails there's enough redundancy in the system that there's not a cascade of failure which takes everything with it.

The thing we did differently post 2008 was Quantitative Easing, and you know how I said earlier that the important thing is to recognise when you're wrong? Well, I got it wrong on QE. It has clearly worked far better than I thought it would. We've avoided the lost decade of the 70s better than I expected. The UK has the strongest economic growth in the west. In fact, the numbers are quite remarkable. Since records began in 1972, six of the seven best months for job creation have occurred in the last two years; in fact, employment is at it's highest in sixteen years - higher, even, than during the years of the boom, thus:

Moreover, the CBI began to track business confidence in 1976, and they report that confidence has never - never - been higher than it is now. And those two things combined with a third factor get very interesting.

You see, a few years ago the war cry of the anti-Coalition was "Austerity isn't working", but if you google that phrase you'll notice only a few holdout diehards are still using it for the simple reason that austerity has clearly pretty much worked. As a result, Ed balls has vanished from our televisions and the war cry has changed. Now the criticism is either that we're experiencing a "Debt fuelled recovery" or that we're into a housing bubble. Let's look at both those claims, shall we?

1) It's a debt fuelled recovery!

No it's not. Investigating this one led me to this interesting little dataset:

There's several things which jump out about this. Firstly, look at the shape of that graph. Recognise it? 'course you do. You saw it earlier and I said there'd be a test. Now you see why it was a credit bubble. And you also see why Blair jumped ship in 2007.

The second thing you should notice is that debt origination in the UK is at historic lows and is still contracting:

Now bring those three things together: Fastest job creation growth since records began, highest business optimism since records began, and historically low debt origination rates. What happens next? I'll leave you lot to figure that one out. Hint: It's positive.

A related criticism is that although employment has risen, productivity and wage growth remains comparatively low. Well, in some ways that's be expected; by comparison productivity growth in the US is high but employment growth has remained steadfastly below UK levels. What's happening is that the UK is trading off productivity for employment. If you want to boost productivity, the easiest way to do that is to sack your 10% least productive staff. As a society, the route the Uk appears to have decided to go is to ensure more people have jobs at the cost of economic productivity - and this hasn't been driven by the government. It's just happened. You'd think my left wing friends would be delighted, but I'm not seeing it.

Just to put the cherry on the cake, the Cost of Employment index has risen for the first time in ages; what that means is that wage growth is reappearing. Hurrah everyone!

2) It's a house price bubble!

No, it's not. There's a couple of things you need to see to understand this one. Firstly is the distribution of rises in housing costs, which looks like this:

It's instantly clear that house price changes are not only concentrated in London, but that prices are falling elsewhere. But what about house prices in London. Are they a bubble?

No. Thus:

If this is a bubble, it's only just begun. However, I don't think it is. Instead, it's something else. I don't know what it is - but I do know what it isn't. It's almost certainly a boom, but booms act differently to bubbles.

Faced with the economic reality, opponents of the coalitions economic policies are reduced to selecting a handy grab-bag of soundbite policies - We should renationalise the railways, we should renationalise energy - in an attempt to draw attention away from the gaping hole in the middle of their economic argument.

The thing is, soundbite policies are demonstrably based upon inaccurate statements. Don't believe me? Allow me:

1) The railways. Nationalisation has failed. We have the highest subsidies of railways in Europe, which go into private companies pockets due to the Tories feeding their fat cat city chums. Or "Bollocks" as I like to call it.

State subsidies to the private train operating companies have fallen astonishingly since Labour left power. From a subsidy of £1.4bn in 2009-10 to the privatised rail industry generating a profit for the government in 2012-13. I'm aware that "Labour subsidising their fat cat city chums" doesn't fit the narrative, but the numbers don't lie even when point-scoring politicians do, and the numbers are here:

From a subsidy of a billion and a half under Labour, the coalition have managed to make a profit of over half a billion quid last year - not that you'll see many people acknowledging it as it doesn't fit their political position. As for the "highest subsidies in Europe" line, that has never held up. France has subsidised their railways more than 30% more than the UK in cash terms over the last decade or so, and in terms of passenger miles the Greeks forked out in excess of 300% what the UK did until the wheels came off their economy. Indeed, massive oversubsidy of their rail system was a contributory factor in the economic collapse of their nation.

Indeed, after all the criticisms of the UK rail network it turns out that according to the European Commission the UK has the second-best railways in Europe after the Dutch, who follow a similar ownership model to the UK.

2) Then there's energy prices. The narrative here is "Privatisation has failed, expensive energy prices, yakketty schmacketty", but once again let's say that's debatable at best. Digging for energy prices got me this interesting dataset, which I've annotated with handy points for convenience:

1) Nationalisation

2) Thatcher

3) Privatisation

4) Labour (and the introduction of carbon taxation).

It's sobering to think that five years ago on these very pages I predicted that government interference in the energy markets would lead to a price bubble, as I didn't realise it was already well under way. Even the Committee on Climate change acknowledges that carbon taxation has led to a rise in energy costs, but hey, that's not stopped people from demanding the energy industry be nationalised. Notwithstanding that doing so would be in breach of EU single market regulations, here's something else to bear in mind: take a look at the end of that price graph. That pattern...looks a bit familiar, doesn't it? It's almost like we've seem something similar, earlier in this post. What this suggests is that energy prices are pretty much peaked and several things serve to back that up; developments in Photovoltaics are especially positive, but hydrocarbon extraction techniques, nuclear, even wind and wave power are improving all the time.

In short: if your idea of a tip-top economic plan which is guaranteed to make everything better is for the government to break international treaties by using taxpayers money to buy the energy industry at the highest price since records began and when it looks probable that prices are going to go into long term decline, then God help you. Really. Nothing else will.

In many ways it's those improvements in technology which are really where I'm going with this post, and indicate where I think a lot of people get economics wrong. I had a conversation with someone a while ago who said that the economy should be managed for the benefit of the people, apparently with a completely straight face. You see, there's no such thing as an economy, or a market, as distinct from the people. What the economy is, is an emergent property of the interactions of untold millions of people all trying to make the best for themselves in whatever way they see fit - so when you talk about managing it you're actually talking about managing people and I think it important to bear that in mind.

And it's people who are the reason the prophets of doom are probably wrong. Here's why:

Over the last few decades, the number of people living in poverty round the world has fallen off a cliff; the entire human race is more prosperous than ever before to a degree it is actually difficult to imagine. Now, I believe people are creative, adaptable, intelligent and imaginative and as they get richer they tend to get better educated, having more time to spend reading books and stuff. What this means that we have an ever-growing mass of educated, intelligent, creative people who are going to be coming up with ways to make your life better. What's more, the richer people get the more peaceful they become, as they've got something to lose by starting fights.

There's a reason the UK is benefiting from this growth in wealth and education in a way that many countries are not - it's because the UK is selling something very few places provide: stability. The Russian and Chinese governments have indicated they aren't to be trusted with your savings, so if you're a Russian and Chinese millionaire where do you put your money? The same goes for Europe - ever since the EU introduced capital controls on Cyprus and the French introduced a 75% top rate we've seen capital flight from the continent to the UK at unprecedented levels. In fact, even as global trade has slowed, it's continued growing in the UK; consider this:

That's because we're honest. As governments around the world decide that sticking their clammy digits ever deeper into their people's savings is a cracking way to cover their own policy failings, their people are smartly removing their money to somewhere that doesn't happen - here. And it's not just individuals, it's major companies. I was delighted to notice the other month that ChryslerFiat, the world's 4th largest car manufacturer, has decided to domicile in the UK - thereby both showing that the Coalition's corporate tax regime is attractive and ending the old "No British companies make cars any more" line in a single stroke.

Whilst on the one hand this influx of cash is driving the rise in property prices (developments in London have been sold off-plan in Hong Kong and never even advertised in the UK**), on the other hand this money is going into companies and stock and shares as investment, which in turn has driven at least some of the rise in employment.

And this is what I meant at the start of this post about there being no such thing as left wing or right wing economics, there's just economics. It's not left or right wing to say that price controls cause shortages; the shortages will happen, and ideology is whether you think that's a good thing or a bad one and if you're prepared to accept the consequences of your actions. In the same way it's not left or right wing to say that people are intelligent, able, creative, imaginative and willing to change their behaviour if it's in their interests to do so. Economics is based upon that observation; the question of ideology is how much you want to control the economy, and that means how much you want to control the people. Conflicts arise when people and governments disagree on what their best interests actually are.

When I started this post, what I really intended to get across is how optimistic I am about the future. I know I've gone all over the place, but my core position is this: people are great. They're clever, imaginative, creative and all that good stuff and they're really good at solving problems. Furthermore, there are more and more rich and educated people all the time, which means we're only going to keep getting better at this.

Yes, there will be recessions and depressions and bubbles and crashes, but barring catastrophe the direction is relentless. If you're unconvinced think about just how much better life got for pretty much everyone who doesn't live in a berserk communist state between the last global crisis in the 1970s and the most recent one now. When I was growing up famine was a regular problem in large parts of Asia and Africa. Now the same parts of the world are worrying about obesity. Stuff like that.

Of course there will be shocks and horrors; patterns play out right up until they don't. NATO and the Ukraine could start shooting each other; the Da'ish could overrun the middle east and introduce a new dark age; we could have a global ecological collapse; China and Japan could start shooting at each other over the Spratleys (possibly the most likely, I think). Prophets of doom will always find an audience, but I'll tell you one thing: the bull market we'll see over the next decade will be the least popular one ever as so many people have pinned their political and economic credibility on it not happening.

Because ye shall hear of wars and rumours of wars, be ye not afeared: for such things must needs be; but the end is not yet.****

*Yes,

**Do rich foreigners have an unlimited appetite for overpriced London property? No.***

***As a good example of the honesty I was talking about earlier, an estate agency friend was telling me about a conversation he had with a Malaysian client recently:

"I do like dealing with British estates agents", said the client. "You're so honest."

"Ah, that's really not how we're seen here", he pointed out.

"Yes, but in Britain when an estate agent sells you a house, you can be confident the house actually exists."

****I think I'll go and get on with writing my book now.

no subject

Date: 2014-08-15 12:07 pm (UTC)no subject

Date: 2014-08-15 02:46 pm (UTC)Many reasons to be cheerful and agree with the thrust of your article but there is a housing bubble and whilst I'm pro inward investment (thrilled at your pitch perfect stock market comments) money also comes into the UK because it's nice here and we're liberal.

Some caution, US didn't want dubai owning it ports and the deal for Cadburys didn't make much sense, nor does takeover of Boots. Sometimes being viewed as the world's overnight account to stick spare cash Bo questions asked has short term gains but leaves longer term questions over the health of the economy and ability to innovate when disparate headquarters are based overseas.

no subject

Date: 2014-08-15 03:10 pm (UTC)no subject

Date: 2014-08-16 06:41 am (UTC)no subject

Date: 2014-08-16 08:16 am (UTC)What GDP represents is not the size or even necessarily strength of the economy, but the flow of money through it: I think this graph demonstrates that quite well:

That's why GDP growth pre-crash was so strong - there was so much money moving through the economy due to the unsustainably high levels of debt being created I said in this post from back in 2005 it wasn't going to work out well,, and hey, whaddya know, it didn't.

What we see is a collapse in the money flow with the crash, followed by a return to money moving again as QE kicks in; between 2008-11 £375bn was printed and that starts moving through the economy boosting GDP and consumption back up. However, as is made clear above, there was no corresponding recovery in either productivity or employment levels. How anyone can claim a recovery when money flows and consumption rise but employment and productivity don't is beyond me, but that's essentially what people who buy the 'choked off recovery' line are doing.

Obviously, printing forever couldn't happen - the purpose was to recapitalise the banking system to prevent a complete failure, and it worked to do that, don't get me wrong - but it couldn't in and of itself create a recovery due to all the debt already in the system.

As the charts of debt growth above show, there has been a length period of deleveraging since the crash which absolutely had to happen and I'd say that the period of QE and deficit has bought the time for that to happen. I said in this post several years ago that average standard of living in the wake of the credit bubble would fall back to 2005 before recovering and that's just what has happened. We've bottomed out and are on the bounce. What's nice about this bounce is that it isn't based on historically high levels of debt being created; indeed, it's happening during a period of historically low debt origination, which is one of the reasons I'm so bullish - as confidence returns, so will debt origination, and so long as interest rates rise (and they will) that's healthy.

Look on the bright side; it's largely uphill from here.

no subject

Date: 2014-08-17 01:31 pm (UTC)no subject

Date: 2014-08-17 04:45 pm (UTC)no subject

Date: 2014-08-17 05:01 pm (UTC)oh we are moving up to Kingston next week so will attempt to make radio contact once I start the new job on Sept 1st. Which rough area do you work in? I'll be Bloomsbury

no subject

Date: 2014-08-17 09:51 pm (UTC)